See Zenda/KFF Health News

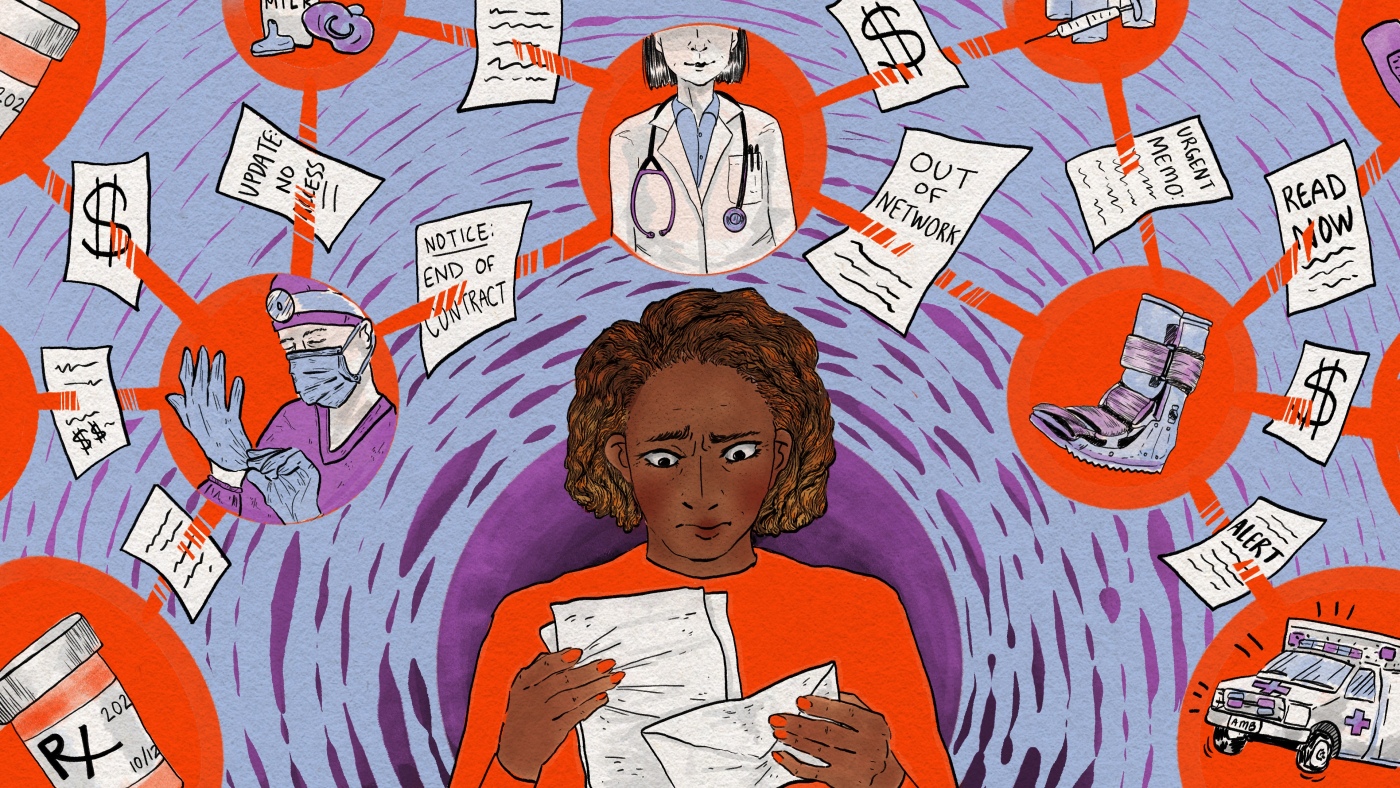

When a Missouri mother’s health insurance company couldn’t reach an agreement with her hospital, most of her doctors suddenly became unavailable. She wondered how she would secure care for her children or find new doctors. “For a family of five… where do we even start?”

Amber Wingler, 42, of Columbia, Missouri

Last winter, Amber Wingler received a series of increasingly urgent messages from her local hospital in Columbia, Missouri, informing her that her family’s health care could soon be upended.

MU Health Care, where most of her family’s doctors work, was mired in a contract dispute with Wingler’s insurance company, Anthem. The existing contract should expire.

Then on March 31, Wingler received an email informing her that Anthem would be removing the hospital from its network the next day. It made her reel.

“I know they’re constantly negotiating contracts … but it just seemed like bureaucracy that wouldn’t affect us. I’ve never been pushed out of the network like that before,” she said.

The timing was terrible.

Wingler’s 8-year-old daughter Cora had unexplained problems with her intestines. Waiting lists for diagnosis from various pediatric specialists, from gastroenterology to occupational therapy, were long – from weeks to more than a year.

Amber Wingler, 41, with her 8-year-old daughter Cora.

Rhiannon Trask

Hide caption

Toggle label

Rhiannon Trask

(In a statement, MU Health Care spokesman Eric Maze said the health system ensures children with the most urgent needs are treated as quickly as possible.)

Suddenly, Cora’s specialist visits were out of network. At a few hundred dollars each, the out-of-pocket costs would have quickly added up. The only other pediatric specialists in the network that Wingler found were in St. Louis and Kansas City, both more than 120 miles away.

So Wingler delayed her daughter’s appointments for months while she tried to figure out what to do.

Contractual disputes are common across the country, as more than 650 hospitals have publicly disputed with an insurer since 2021. That could happen are becoming even more common While hospitals are bracing for about $1 trillion in federal health spending cuts ordered by President Donald Trump Signature legislation come into force in July.

Patients caught in a contract dispute have few good options.

“There’s this old African saying: When two elephants fight, the grass gets trampled. And unfortunately in those situations, the patients are often grass,” said Caitlin Donovan, executive director of the Patient Advocate Foundation, a nonprofit that helps people access health care.

If you feel like you’re being affected by a contract dispute between a hospital and your insurer, here’s what you need to know to protect yourself financially:

1. “Out of network” means you will likely pay more

See Zenda/KFF Health News

Insurance companies contract with hospitals and other medical providers to determine the rates they pay for various services. If an agreement is reached, the hospital and most providers who work there become part of the insurance company’s network.

Most patients prefer to see providers who are “bonded” because their insurance will cover some, most, or even all of the bill, which can be hundreds or even thousands of dollars. If you see an out-of-network provider, you may be on the hook for the entire tab.

If you decide to stick with your trusted doctors even though they are out of network, ask about a discount and about the hospital’s financial assistance program.

2. Differences between hospitals and insurers are often closed

As a health policy researcher at Brown University Jason Buxbaum He examined 3,714 nongovernmental hospitals in the U.S. and found that about 18% of them had a public dispute with an insurance company sometime between June 2021 and May 2025.

According to preliminary data from Buxbaum, about half of those hospitals ultimately dropped out of the insurance company’s network. But most of these breakups are ultimately resolved within a month or two, he added. So it’s entirely possible for your doctors to stay in the network again even after a separation.

3. You may be eligible for an exemption to reduce costs

Certain patients with serious or complex illnesses could be eligible for an expansion of in-network coverage called continuity of care. You can request this extension by contacting your insurer. However, keep in mind that this can be a lengthy process. Some hospitals have even set up resources to help patients apply for this extension.

See Zenda/KFF Health News

Wingler ran the gauntlet for her daughter, spending hours on the phone, filling out forms and sending faxes. But she said she doesn’t have the time or energy to do that for everyone in her family.

“My son was doing physical therapy,” she said. “But I’m sorry dude, just do the exercises you already have. I’m not fighting to keep you covered when I’m already fighting for your sister.”

Also note that most emergency services are hospitals if there is a medical emergency You can’t ask for more than a patient’s in-network rates.

4. Changing your insurance carrier may have to wait

Maybe you’re thinking about switching to an insurer that covers your favorite doctors. But be aware: Many people who select their insurance plan during an annual open enrollment period are locked into their plan for a year. Insurance contracts with hospitals are not necessarily on the same schedule as your “plan year.”

Certain life events Events such as a marriage, the birth of a child, or a job loss may entitle you to switch insurance outside of your annual open enrollment period, but your physicians leaving an insurance network is not a qualifying life event.

See Zenda/KFF Health News

5. Doctor visits can be time-consuming

If the disconnect between your insurance company and your hospital seems permanent, you should consider finding a new group of doctors and other providers who are in-network with your plan. Where do you start? Your insurance company probably has an online tool you can use to search for in-network providers in your area.

But be aware that switching may mean having to wait until you are established as a patient with a new doctor and, in some cases, requiring a long journey.

6. It’s worth keeping the receipts

Even if your insurance company and your hospital don’t reach an agreement before their contract expires, there’s a good chance they’ll still reach a new agreement.

Some people decide to reschedule appointments while they wait. Others keep their appointments and pay out of pocket. In this case, keep your receipts. When insurers and hospitals come to an agreement, the contracts are often made retroactively, so the appointments you paid for out of pocket could still be covered.

End of an ordeal

Three months after the contract between Wingler’s insurance company and the hospital expired, the sides announced they had reached a new agreement. Wingler joined the throng of patients rescheduling appointments they had rescheduled during the ordeal.

See Zenda/KFF Health News

In a statement, Jim Turner, a spokesman for Anthem’s parent company, Elevance Health, wrote: “We are approaching the negotiations with a focus on fairness, transparency and respect for all affected.”

Maze of MU Health Care said, “We understand how important timely access to specialty pediatric care is to families, and we sincerely regret the frustration some parents have experienced in scheduling appointments following the resolution of our Anthem contract negotiations.”

Wingler was happy that her family could see their caregivers again, but her relief was tempered by her resolve not to end up in the same situation again.

“I think we’ll be a little more diligent with open enrollment,” Wingler said. “We never really bothered to look at our deductible before because we didn’t need it.”

The Health Care Helpline helps you overcome the hurdles in the healthcare system that separate you from good care. Send us your tricky question and we may hire an expert to find the solution. Share your story. The crowdsourcing project is a joint production of NPR and KFF Health News.

KFF Health News is a national newsroom that produces in-depth journalism on health issues and is one of the core operating programs of KFF.

Source link

, , #doctors #excluded #health #insurance #network #NPR, #doctors #excluded #health #insurance #network #NPR, 1761595447, what-to-know-if-your-doctors-are-excluded-from-your-health-insurance-network-npr