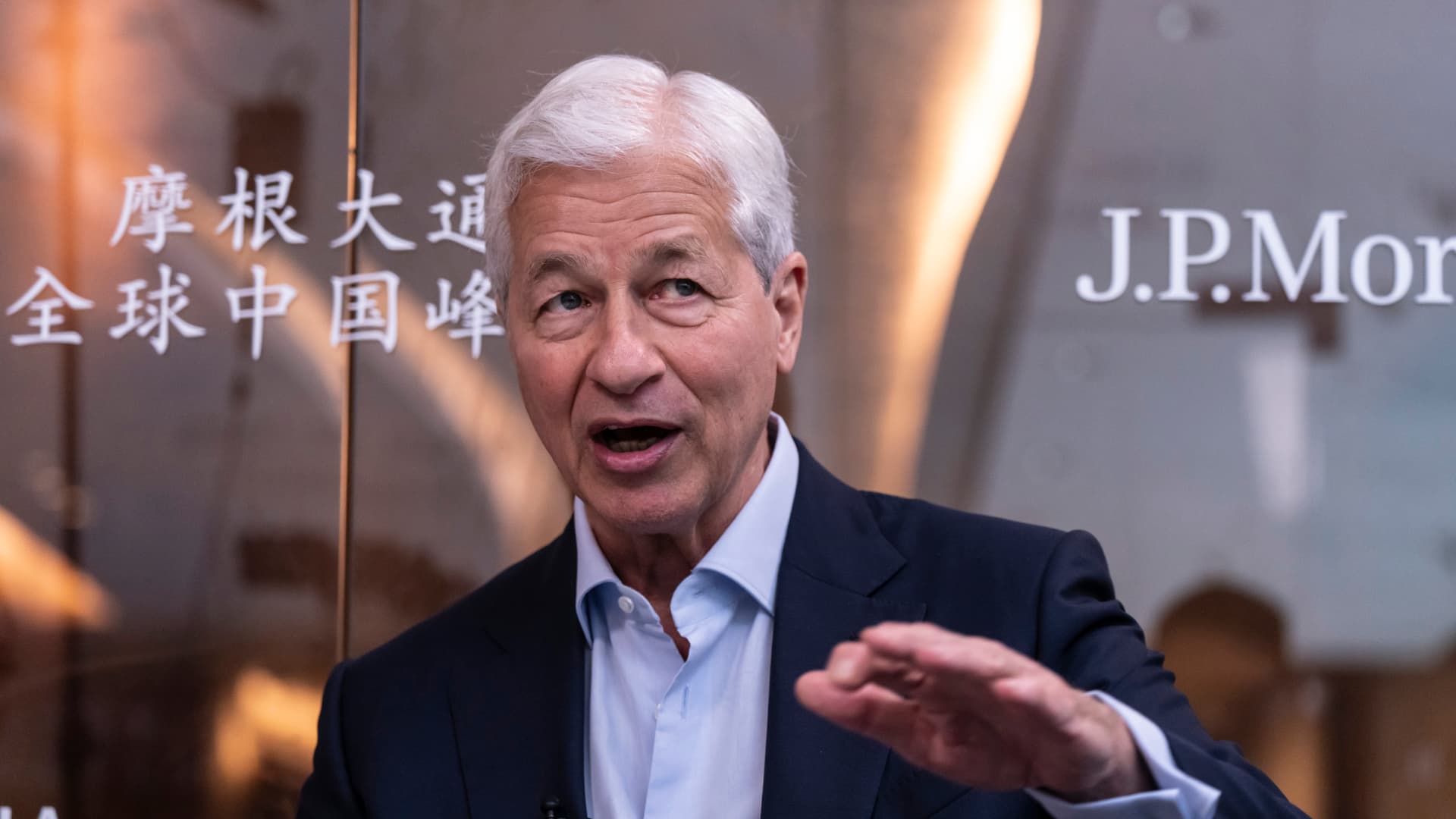

Jamie Dimon, general director of JPMorgan Chase & Co., during the television interview Bloomberg off the beaten track of the JPMorgan China summit in Shanghai in China, on Thursday, 22 May 2025.

Qilai Shen Bloomberg Getty images

Once laggard in an online investing game, Jpmorgan chase Now he thinks he is a leader.

On Friday, the bank is to present new tools that allow investors to investigate and buy bonds and indirect deposit certificates via the mobile application, CNBC is first notification.

According to JPMorgan directors, users can configure adapted screens and compare bond yields in the same banking or internet portal, which they use to check the account balances. Movements are part of the joint effort to increase the bank’s references among investors who trade several times a month.

“Our goal was to create an experience that makes it extremely simple for customers who want to buy a constant income,” he said Paul VienickThe head of online investing in the JPMorgan property management shoulder. “We have undertaken an accurate thought process for simplicity [buying] Stocks and ETF and it moved to a constant income space. “

JPMorgan, the largest American Bank according to assets and a leader in most major finance categories, is relatively small compared to other brokerage houses. CNBC learned that despite the vision of regular profits in recent years, because it added functions, including the possibility of buying fractional shares, the bank has only recently exceeded assets of $ 100 billion.

It’s pales compared to online investing giants, including Charles SchwabFidelity or E-Trade, which had decades for the collection of investors and the takeover of competitive platforms.

“Conducting this thing”

The bank for the first time tried to catch more trillion dollars that self -proclaimed investors have, introducing Free trade service In 2018, JPMorgan called him a “invest” and sold a new name in pushing, which covered a significant place in the US Open Tennis.

But by 2021, JPMorgan saw that the brand was not connected as she counted, and headed to call it a self -proclaimed investment platform.

This year, in the case of a company management company about $ 55 billion, CEO Jamie Dimon he called the company’s product in his own Usually a blunt way.

“We don’t even think it’s still a very good product,” Dimon he said Analysts at a financial conference. “So we run it.”

Part of the JPMorgan trading was the employment of Vienick, a veteran TD American, Morgan Stanley AND Bank of AmericaIn October 2021, to review the bank’s efforts.

“It was recognized that in property management we are catching up at all,” said Vienick in a recent interview at the headquarters in New York Bank.

It also includes managing more money Wealthy Americans Through financial advisers in physical locations, the emphasis that JPMorgan’s helped 2023 purchase of the first republic. JPMorgan Banks half of 19 million wealthy households, but it only has 10% Participation in investment dollars.

The industry now recognizes that providing good internet tools is table rates, even if the emphasis was previously placed on financial advisers of people who earn more revenues, providing more services.

Vienick said that about half of people using a financial advisor also invest in online tools.

Next stop: 1 trillion dollars?

Now the bank wants to aim at more involved investors, those who study and buy shares several times a month and who are more likely to directly buy bonds than to have them through investment funds.

Currently, it offers clients up to 700 USD for the transfer of funds to their self -proclaimed platform.

In the further part, the bank is working on providing users with the possibility of carrying out the campaign after hours, said Vienick.

All this is part of the bank’s efforts to convince customers who are already banking with JPMorgan or have their credit cards to consolidate more of their portfolio with the company. In this way, he will allow the investor to have one view of his finances and move the money immediately between the accounts, said Vienick.

The advantages of the bank – its extensive network of branches, a deep balance and reputation under Dimon – can be sure that JPMorgan will eventually join other large players among brokerage houses.

“I have all the belief that self-proclaimed business, apart from basic property management, can be a Biliona dollars company,” said Vienick. “It requires hard work. This means that we provide what customers are asking for.”

Source link

, Charles Schwab Corp,Bank of America Corp,Morgan Stanley,Jamie Dimon,Jamie Dimon,Jpmorgan chase & co,Breakingnewsglobal,Investment strategy,News about the turn: Investing,Banks,News about the turn: markets,Business news , #mobile #application #adds #trade #bonds, #mobile #application #adds #trade #bonds, 1750444574, the-mobile-application-adds-trade-in-bonds