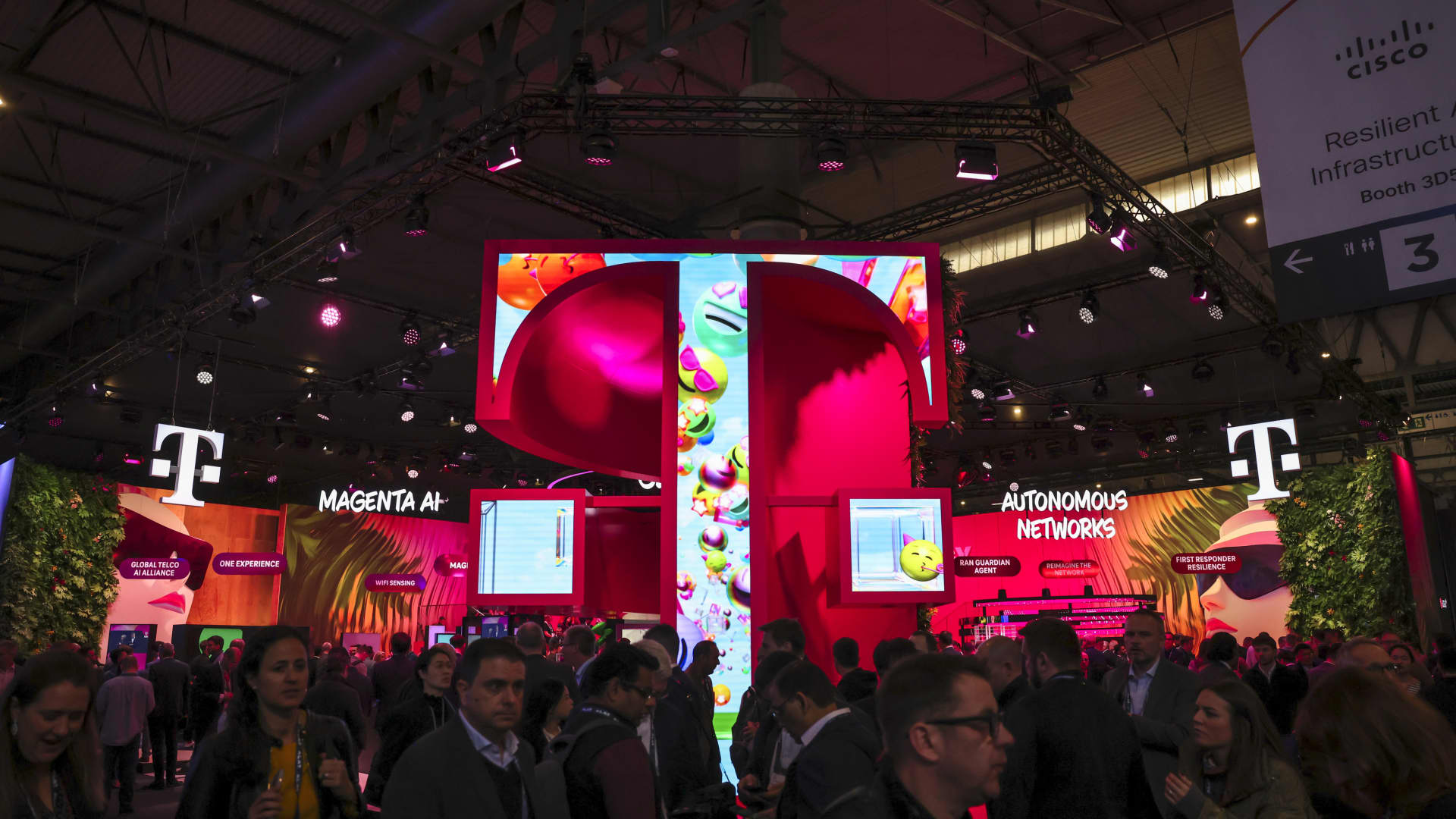

The Deutsche Telekom pavilion at Mobile World Congress in Barcelona, Spain.

Angel Garcia Bloomberg Getty images

Barcelona – European telecommunications companies are increasing calls for greater industry consolidation to help the region more effectively compete with superpowers such as the USA and China in the field of key technologies, such as 5G and artificial intelligence.

Last week, at the Mobile World Congress (MWC) in Barcelona, general directors of several telecommunications companies called regulatory authorities to help them combine operations with other companies and a reduction in the total number of carriers operating throughout the continent.

Currently, many EU countries operate in many Telco players and members outside the EU, such as Great Britain, but Telco bosses have told CNBC that this situation is unstable, because they are not able to effectively compete when it comes to the price and quality of the network.

“If we intend to invest in technology, in deep knowledge and we will introduce drastic changes, positive drastic changes in Europe-like other large technology companies in the USA or we see today in China-we get the scale”, Marc Murtra, general director of the Spanish telecommunications giant TelephoneKaren TSO from CNBC said in an interview.

“To be able to get a scale, we must consolidate a fragmentary market, such as the telecommunications market in Europe,” added Murtra. “And for this we need regulations that allow us to consolidate. So please: free us. Let’s get a scale. Let’s invest in technology and introduce productive changes. “

Christel Heyyemann, CEO of the French carrier OrangeHe said that although some mega-deal activities are starting to accumulate the tempo in Europe, you should do more to guarantee the competitiveness of the continent on the world stage.

Last year, Orange has completed a agreement on the merger of Spanish operation with the local Masmovil mobile network supplier. Meanwhile, recently, the British author of competition and marketsYou approved the connection of 15 billion pounds ($ 19 billion) between telecommunications companies Vodafone and three in Great Britain, subject to certain conditions.

“We actively consolidated in Europe,” said CNBC from Orange from Orange. “We see how it changes now. There is still a lot of hope. “

However, she added: “I think that in Europe there is a lot of pressure on the business environment in our political leaders to do things to change. But things have not really changed yet. “

During the fiery speech on Monday, the General Director of the German Telco Deutsche TelekomTim Höttges, said that other Telco markets, such as the USA and India, only condensed a handful of players.

American industry Telco is dominated by the three largest mobile network operators, VerizonIN At & t AND T-Mobile. T-Mobile is the property of the majority by Deutsche Telekom.

The graph comparing results in the price of T-Mobile, the largest in America Telco according to market capitalization, with the German Deutsche Telekom and France Orange.

“We need a reform of competition policy,” said Höttges on the stage in MWC. “We must have permission to consolidate our activities.”

“There is no reason for each market to operate with three or four operators,” he added. “We should build a uniform European market … Because if we cannot increase our consumer prices, if we cannot download players, we must get performance from the scale we have created.”

“Over-the-Top” refers to media platforms such as Netflix which provide content via the Internet, bypassing traditional cable networks.

Europe’s competitiveness is concentrated

From artificial intelligence to a new generation of 5G, European telecommunications companies intensively invest in new technologies to go beyond the older model of cable laying, which enable internet connectivity-a business model that has gained a pejorative term “stupid pipes”.

However, this expensive modernization undertaking took place in a tandem with a slow increase in revenues and the inability of the sector to effectively earn on their networks to the same extent as technological giants have done with the appearance of mobile applications, and recently AI generative tools.

In MWC, many mobile network operators talked using artificial intelligence to improve the quality of the network, better customer service and gain market share from competitors.

Despite this, European Telco bosses claim that they could accelerate their digital transformation travels if they could connect with other large international players.

“He is currently focusing on European competition,” said Luke Kehoe, an industry analyst in Europe at the OOKLI intelligence company, said CNBC on the margins of MWC last week. “There is a purpose of mobilizing politics to improve telecommunications networks.”

In January, the European Commission, the executive body of the European Union, issued the so -called “competitiveness compass” to EU legislators.

The document requires, among others, “changed guidelines regarding the assessment of the merger, so that innovation, resistance and intensity of competition investments in some strategic sectors receive adequate weight in the light of the sharp needs of the European economy.”

Meanwhile, last year, the former president of the European Central Bank Mario Draghi published The long -awaited report, which called for radical reforms to the EU Through a new industrial strategy to ensure its competitiveness.

It also requires a new act on digital networks, which would try to improve incentives for Telco to build new generation mobile networks, reduce conformity costs, improve communication for end users and harmonize EU policy in a network spectrum or the scope of radio frequencies used for wireless communication.

“The common topic and music of mood certainly reduces the ex-ante regulation and supporting what they would call a more competitive environment, which is a more favorable environment,” said CNBC from Ookla Kehoe. “Going forward, I think there will be more consolidation.”

Kehoe added, however, that the Telco industry has many ways to see transformational mergers and cross -border acquisitions.

For many TELCO analysts, the requirements for increased consolidation are nothing new.

“European Directors Telco have never been ashamed to call for consolidation and growth regulations,” said CNBC Nik Willets, CEO of Telco Industry Association TM Association TM Forum. “But the adjustment is only one piece of the puzzle.”

“Over the past 12 months, we have seen new energy from our members in Europe to deal with a huge task to transform: simplifying, modernizing and automating their activities and older technology.”

“This will allow you to quickly adapt to the new needs of customers and market realities, regardless of whether building new partnerships, passing mergers and acquisitions or delaying integrated companies – all trends that we expect to achieve in the next 24 months” – he added.

Source link

, Mergers and acquisitions,Netflix Inc,T-Mobile US Inc,At & t Inc,Verizon Communications Inc.,Markets,Technology,News about the turn: Technology,Media,Telecommunication,Telefonica with,Orange to,Deutsche Telekom AG,Vodafone Group PLC,Business news , #Europa #Telcos #calls #megameters #catch #China, #Europa #Telcos #calls #megameters #catch #China, 1741984159, europa-telcos-calls-more-mega-meters-to-catch-up-in-china-at-5g